DEPARTMENT OF NATIONAL PLANNING AND MONITORING AUDIT CHARTER

1) Overview

The Department of National Planning and Monitoring's Internal Audit Charter was established in light of the Finance Instruction (FI) 02/2009 released on 1 December 2009 issued by Department of Finance titled "Establishing Internal Audit Units and Audit Committees to support Compliance with the Public Finance (Management) Act, 1995".

Part 1. d) of the FI states that "All government entities that receives grants from the State and are subject to audit by the Auditor General, to establish Internal Audit Units and Audit Committees".

The FI also listed the following requirements: (a) Code of Ethics for Internal Audit Unit; (b) Code of Ethics for Audit Committee Members; (c) Internal Audit Charter; and (d) Audit Committee Charter.

Part 7 of the FI "Operation of Internal Audit Units and Audit Committees" specified that National Departments, Provincial Departments, Statutory Authorities, Public Bodies and Other entities subject to this FI shall adopt and comply with the Audit Committee Charter, Audit Committee Code of Ethics, Internal Audit Charter and Internal Audit Code of Ethics.

2) DNPM Adoption of the Internal Audit Charter

Department of National Planning and Monitoring adopted the Public Service Internal Audit Charter on 14 March 2018. The DNPM Audit Committee was launched in 2020. The first Audit Committee Meeting will be held this year, 2022.

The Internal Audit Charter – is a document which provides the organization a blueprint for how Internal Audit operates and allows the governing body (Audit Committee) to clearly signal the value it places on Internal Audit's independence.

The Internal Audit Charter basically covers the following areas:

i. Independence of Internal Audit Unit and Internal Auditors

ii. Professional Proficiency of the Internal Audit Unit and Internal Auditors

iii. Scope of Work to be performed by Internal Audit Unit

iv. Performance of Internal Audit Work

v. Management of the Internal Audit Unit

vi. Objective and Scope of Internal Auditing

vii. Authority of Internal Audit Unit

viii. Scope of Work performed by Internal Auditors and

ix. Other responsibilities of the Internal Audit Unit

3) DNPM's Work in Progress

Corporate Governance and Compliance Division basically concentrates both in the:

a. Internal Audit – Assess activities and expenditure under Re-current Budget to ensure compliance to set systems and procedures and

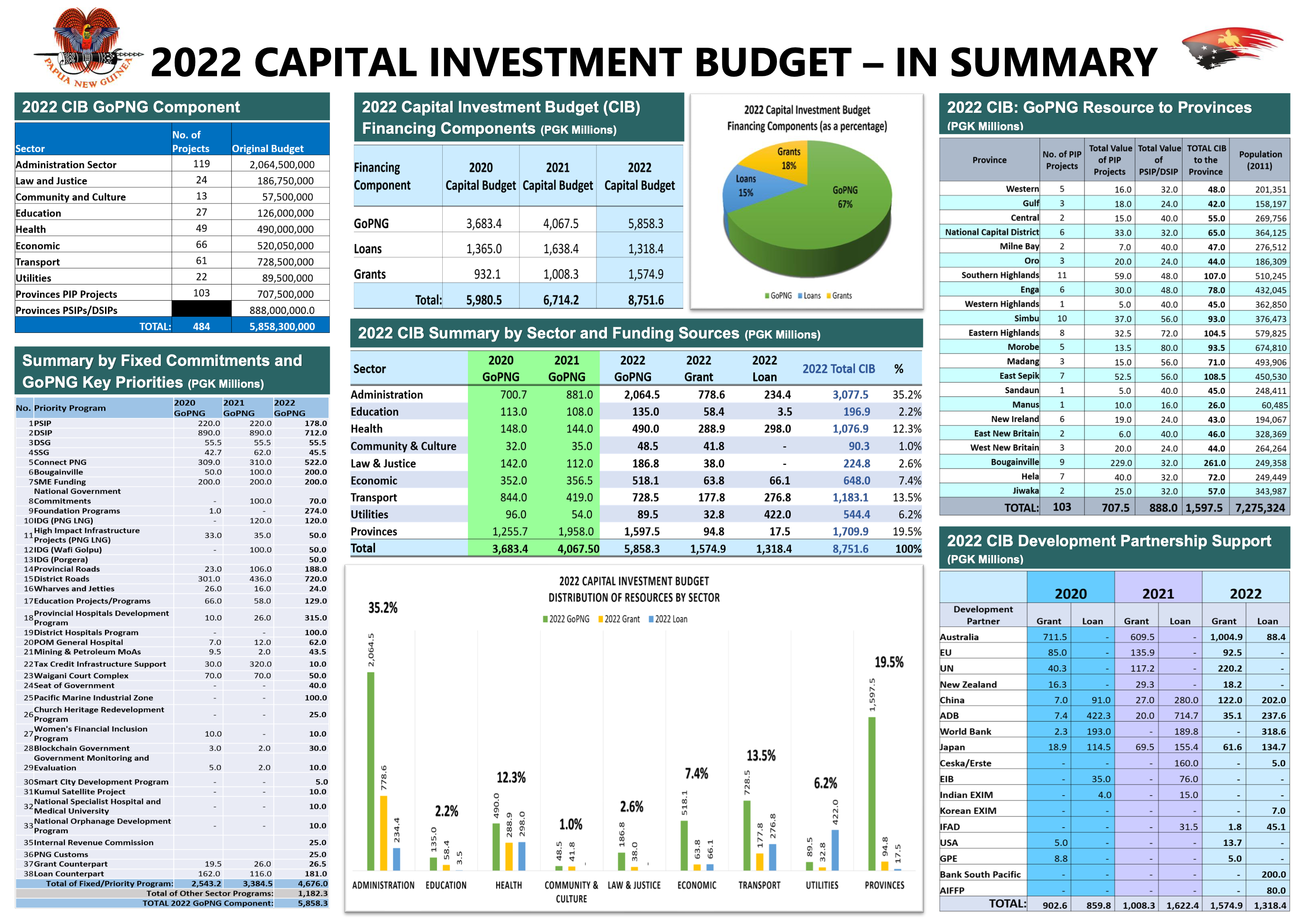

b. Project Audit – Conduct audit & evaluate project/program activities and expenditures under the Capital Investment Budget.

1) Overview

The Department of National Planning and Monitoring's Internal Audit Charter was established in light of the Finance Instruction (FI) 02/2009 released on 1 December 2009 issued by Department of Finance titled "Establishing Internal Audit Units and Audit Committees to support Compliance with the Public Finance (Management) Act, 1995".

Part 1. d) of the FI states that "All government entities that receives grants from the State and are subject to audit by the Auditor General, to establish Internal Audit Units and Audit Committees".

The FI also listed the following requirements: (a) Code of Ethics for Internal Audit Unit; (b) Code of Ethics for Audit Committee Members; (c) Internal Audit Charter; and (d) Audit Committee Charter.

Part 7 of the FI "Operation of Internal Audit Units and Audit Committees" specified that National Departments, Provincial Departments, Statutory Authorities, Public Bodies and Other entities subject to this FI shall adopt and comply with the Audit Committee Charter, Audit Committee Code of Ethics, Internal Audit Charter and Internal Audit Code of Ethics.

2) DNPM Adoption of the Internal Audit Charter

Department of National Planning and Monitoring adopted the Public Service Internal Audit Charter on 14 March 2018. The DNPM Audit Committee was launched in 2020. The first Audit Committee Meeting will be held this year, 2022.

The Internal Audit Charter – is a document which provides the organization a blueprint for how Internal Audit operates and allows the governing body (Audit Committee) to clearly signal the value it places on Internal Audit's independence.

The Internal Audit Charter basically covers the following areas:

i. Independence of Internal Audit Unit and Internal Auditors

ii. Professional Proficiency of the Internal Audit Unit and Internal Auditors

iii. Scope of Work to be performed by Internal Audit Unit

iv. Performance of Internal Audit Work

v. Management of the Internal Audit Unit

vi. Objective and Scope of Internal Auditing

vii. Authority of Internal Audit Unit

viii. Scope of Work performed by Internal Auditors and

ix. Other responsibilities of the Internal Audit Unit

3) DNPM's Work in Progress

Corporate Governance and Compliance Division basically concentrates both in the:

a. Internal Audit – Assess activities and expenditure under Re-current Budget to ensure compliance to set systems and procedures and

b. Project Audit – Conduct audit & evaluate project/program activities and expenditures under the Capital Investment Budget.